고정 헤더 영역

상세 컨텐츠

본문

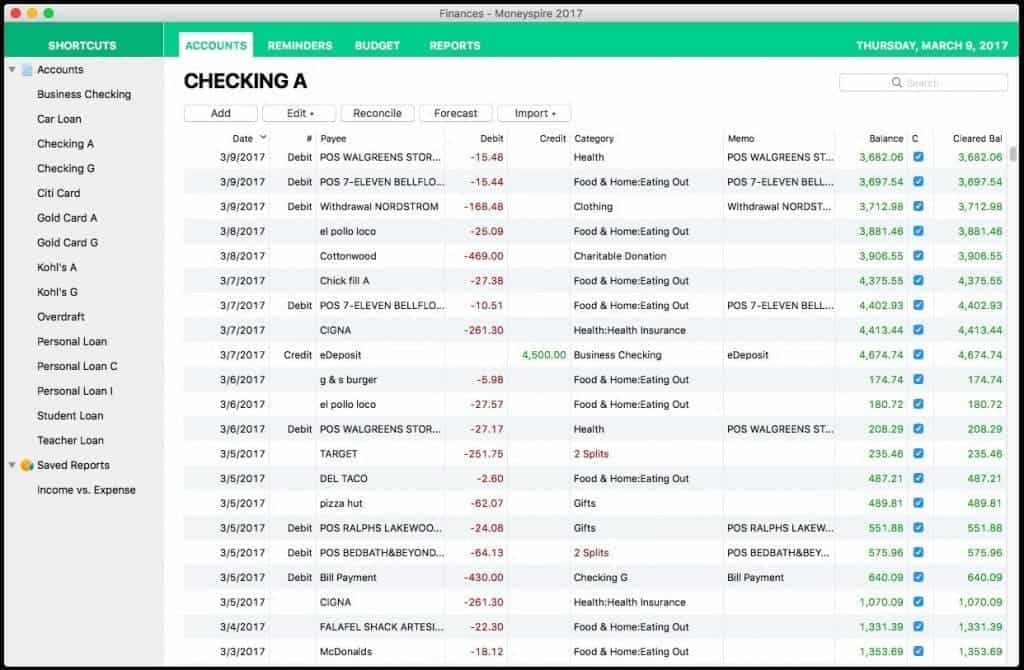

Size: 27.66 MB Moneyspire 2017 is the comprehensive, user-friendly personal-finance app that brings your entire financial life together in one place and helps give you peace of mind. Keep track of your bank accounts, credit cards, etc., and organize your transactions and see where your money is going. Set bill reminders and see all your upcoming payments so you never forget to pay a bill again. Set a budget for all your expenses and keep track of your progress to help you stick to your budget.

Download Moneyspire 2017 17 0 28 MAC OS X - ReleaseLoad Torrent in HD Quality and All Available Formats. Visit us for More Fresh Torrents.

Download Moneyspire For Mac Review

Generate detailed reports and charts and see exactly where your money is going, and make tax time easier. Features A clean easy-to-use interface Mobile companion app, plit transactions, Reconciliation, Multiple currency support, QIF, QFX, OFX and CSV file import and more WHAT’S NEW Version 17.0.28: Release notes were unavailable when this listing was updated REQUIREMENTS OS X 10.7 or later Related Torrents torrent name size age seed leech.

Download Money Spire For Mac 2017

Advertisement Keeping track of your If you want to get ahead in life, personal finance is a necessary skill. Make sure you up to speed with these awesome free eBooks. Can be a hassle, especially if you have a lot of accounts or you run a small business. There are some great When it comes to online budgeting and expense tracking, there are plenty of solutions, but two of the biggest names in the business are Mint and You Need a Budget (YNAB)., but many people prefer to have dedicated software on their home computer to keep track of everything. Quicken is the biggest name in the business, but what else is out there? These five apps will help you budget, keep track of spending, and monitor your investments from your Mac.

($35 / $70) It might not win any aesthetic awards, but Moneyspire is a fast and versatile personal finance client. Its strengths include direct connection to your bank, a Reminders view that keeps you on top of upcoming bills and paychecks, multiple-budget support, and balance forecasting (though it’s not clearly explained how this is done; it appears to just look at recurring transactions, so it might be a rather simplistic forecast). Moneyspire also lets you use If you've sent money abroad or exchanged currencies before a vacation, you probably got a poor deal. Here are some better alternatives to banks and currency exchanges. On your accounts, which will be really useful for anyone who’s moved to a different country or does business internationally. The interface isn’t especially striking, but it’s very easy to navigate quickly. There aren’t many downsides to Moneyspire, but some of them might be deal breakers.

The Reports tabs aren’t especially insightful; they show you your cash flow, tax-related cash flow, expenditure by category, and net worth over time. Not every bank is available for Direct Connect, and you’ll need to make sure your accounts allow Quicken-style access, which could cost money. And PayPal isn’t supported. Also, you only get Direct Connect with the premium version of the app, which costs twice as much. The basic version requires that you download your transactions manually. Moneyspire seems like a good option for people who run small businesses and want to use the same software for both home and business accounts.

Being able to create multiple data files and multiple budgets within each file means you can manage a lot of different financial information at once. ($60) Formerly called “iBank,” Banktivity 5 is a powerhouse of a personal finance app. Some of its most notable features include very nice-looking, print-friendly reports, support for multiple currencies, easy attachment of images to any transaction for These receipt scanner apps will help you scan, save, and organize every receipt for your personal or business needs., financial quotes, many investment-related capabilities, and key facts in the Overview. Although you’ll need to have a subscription plan (for $40 per year) to get direct, automatic access to your bank accounts, Banktivity makes it easy to download and import your transactions directly within the app.

To make sure all of your accounts are displaying the right amount, though, you might need to do some extra work compared with automatic downloads. Banktivity also has a great budget-creation wizard that walks you through setting up budget for income, regular expenses, unplanned expenses, bonuses, unscheduled income, and more.

Creating multiple budgets could be useful for multi-person families or small business owners, and the option to budget in the “envelopes” method, much like You Need a Budget (a Does your checking account remind you of a debt-burdened Southern European nation? You Need A Budget. We know it's tough to keep track of spendings. YNAB can help. Around here), provides another good way to keep track of your money. Like Moneyspire, Banktivity is probably best for people who have complicated budgeting and tracking needs; if you do a lot of investing in different places or run a small business, for example. The price tag combined with the subscription fee for automatic updates on your accounts can add up quickly, and likely won’t be worth it for the average user.

($50) If you like the overview that your checkbook register gives you of your transactions, you’ll like Moneydance’s transaction screen, as it’s styled after the log you might be familiar with. Other features include automatic transaction downloading and categorization, online bill pay, a nice overview screen, good support for investments, and useful reports and graphs.

The inclusion of exchange rates on the overview screen is a nice touch for users with international accounts, too. The investments screen is especially nice, as it gives you a lot of useful information in a small space. By automatically downloading investment information, you’ll always have the most up-to-date information on your stocks, bonds, and other investments, as well.

The wide variety of views, including charts and graphs, is really nice, and can easily be accessed with a couple clicks in the sidebar. Overall, Moneydance doesn’t have many downsides. Because I was working with a free trial, I couldn’t use its ability to connect to a bank, so I had to download and import my transactions, which was kind of a pain, but I was able to get a good overall idea of how to use the app. The price will still be prohibitive for many users, making this, like the other choices, best for people who want an all-in-one solution for multiple accounts and different subsets of accounts. ($60 / $30 during Preview Sale) Fans of You Need a Budget will like MoneyWell; the layout is very similar to YNAB’s online client, and budgeting works in the same way. The The world of online shopping evolves so quickly, it can be hard to keep up with the terminology.

Here are a handful of terms that we think everyone should know for their own good! Is one that’s been around for a long time, and has worked for a lot of people, so there’s a good chance that MoneyWell’s system will work for you. The income/expense graph that can be displayed at the bottom of the transaction screen is a very convenient way to see how your monthly cash flow has been going, which is always a good thing to have front and center. MoneyWell’s interface is really nice — possibly the nicest of all the apps reviewed here.

While it doesn’t display quite as much information as some of the other options, it’s very clean and easy to read, and it doesn’t look like it was designed in the 90s.